Why Sanctions Failed to Restrain Russia’s Oligarchs

Companies facing international restrictions stay alive by playing a game of “regulatory arbitrage.”

AI Is Reshaping Accounting Jobs by Doing the “Boring” Stuff

Streamlining routine bookkeeping gives accountants more time to help clients and handle complex tasks.

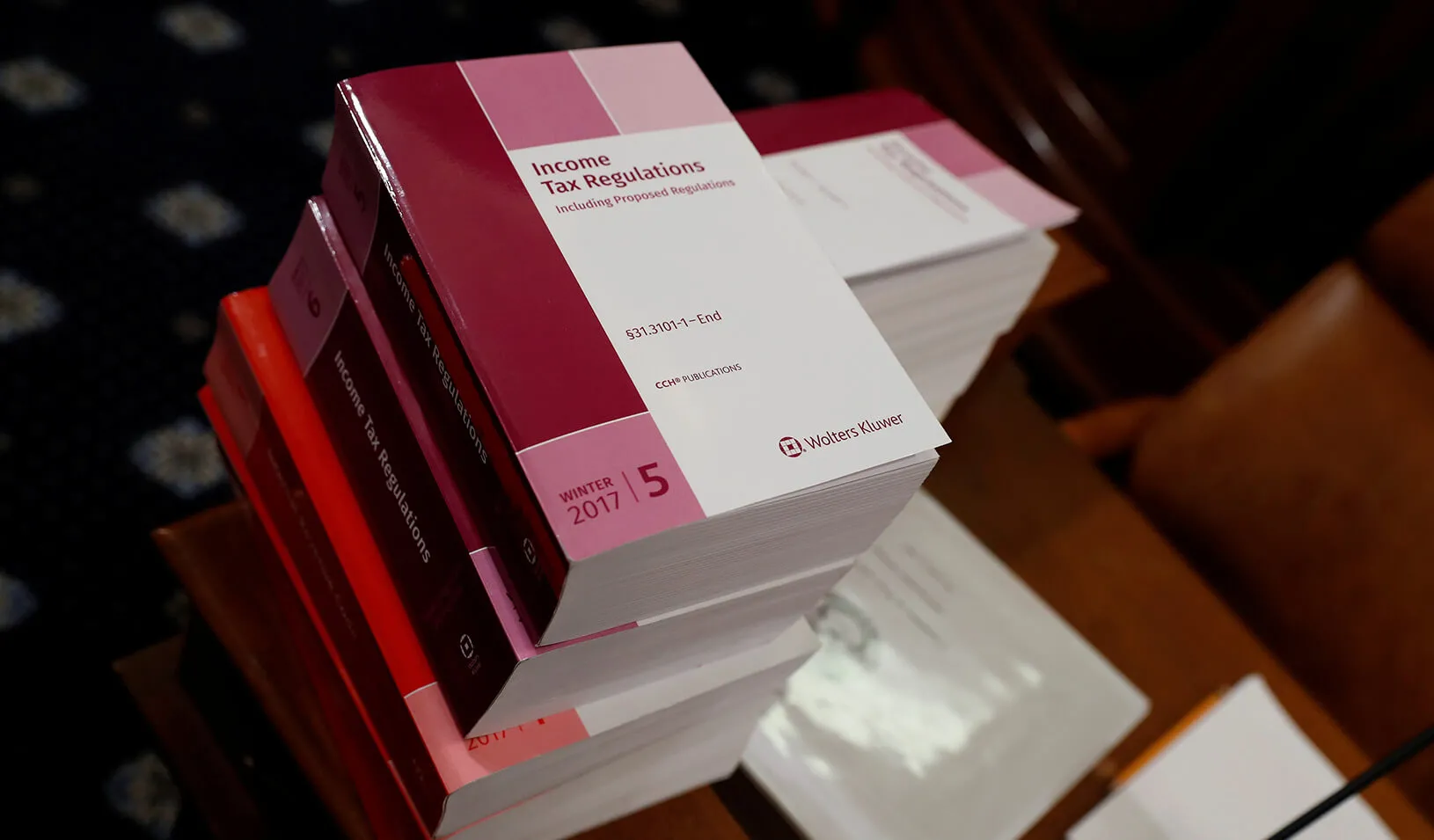

Mapping the Maze Where the IRS Could Find Billions in Unpaid Taxes

Researchers are untangling the incredibly complex corporate structures some taxpayers use to reduce their tax bills.

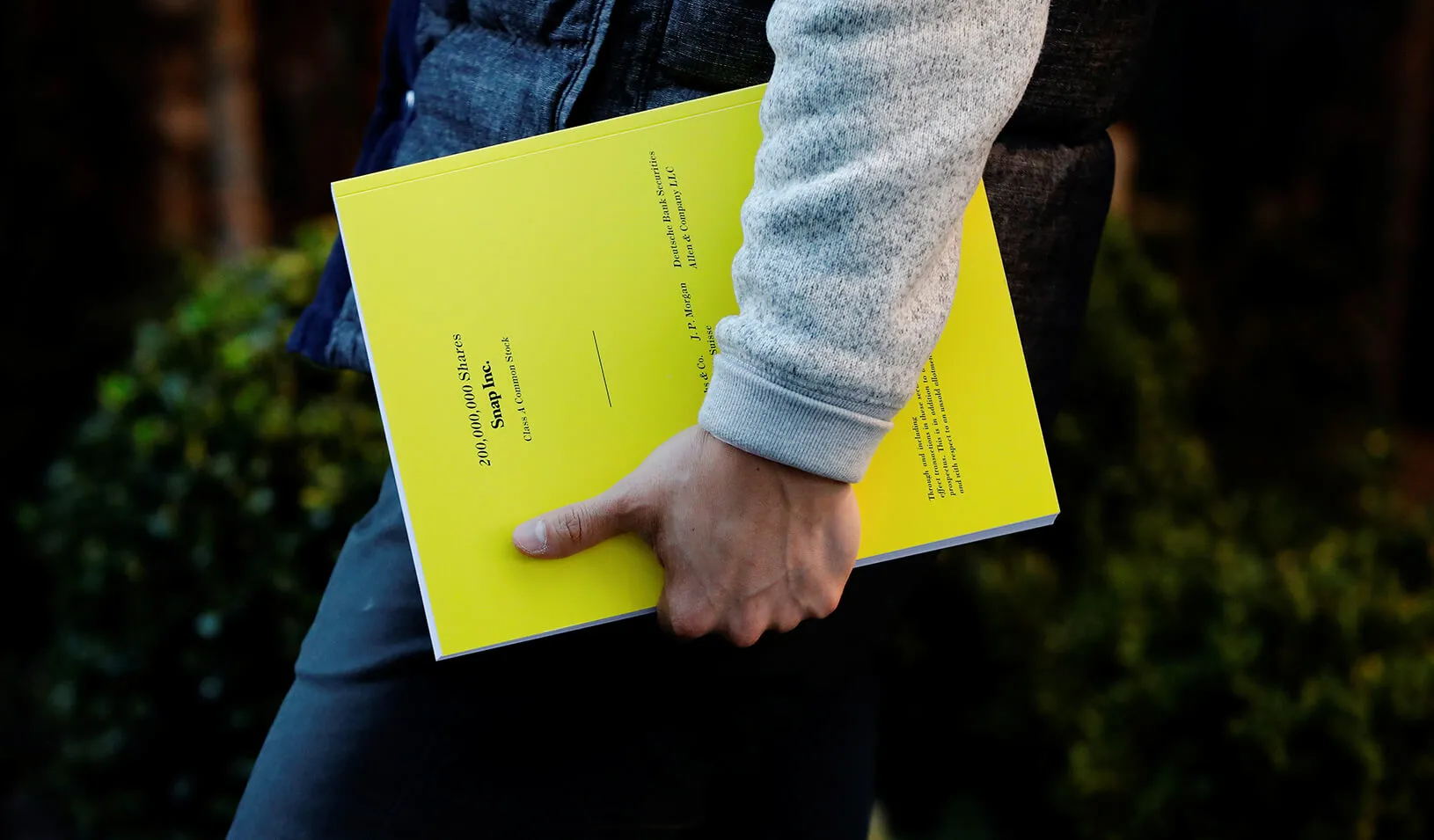

When Companies Announce Earnings Surprises, Locals Reach for Their Pocketbooks

Unexpected news about a company’s profits can have a big impact on people who live near its HQ.

Money Talks: Understanding the Language of Business

If we want to make more empowered decisions, then we need to care about accounting.

See also Corporate Governance

Learn about corporate accountability and social responsibility, and the operational structures of corporations.