Why Even Well-Known Brands Can’t Stop Advertising

Advertisers must constantly fight to dislodge the competition from the top of consumers’ minds.

What’s the Price Tag for Preventing an AI Apocalypse?

Like all numbers associated with AI, it’s really, really big.

How Technology Can Evolve Without Overwhelming Our Brainpower

As innovations get ever more complicated, people keep figuring out ways to ease the cognitive burden.

How to Talk About Climate Change Across Political Divides

A “tournament” of common climate messaging strategies finds which are more likely to sway opinions.

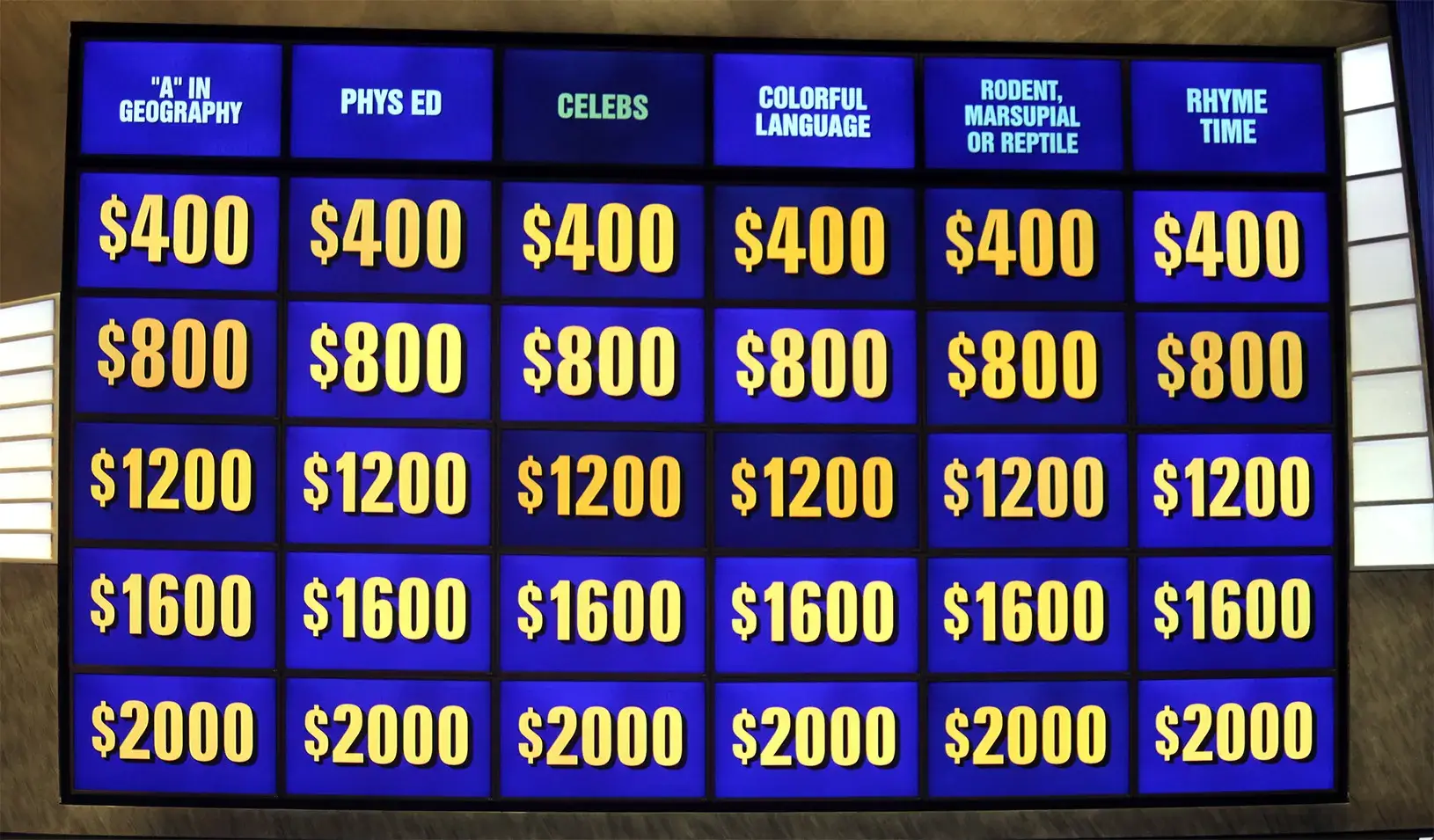

Clicks, Drags, and Whips: When Taking Digital Surveys, Your Movements Matter

Survey interfaces have subtle effects on people’s responses. And those small differences can add up.

How Fast Fashion Stays Fresh — and Adapts to U.S. Tariffs

New import duties caused “ultra-fresh” fashion companies to pivot and led to less consumer waste.

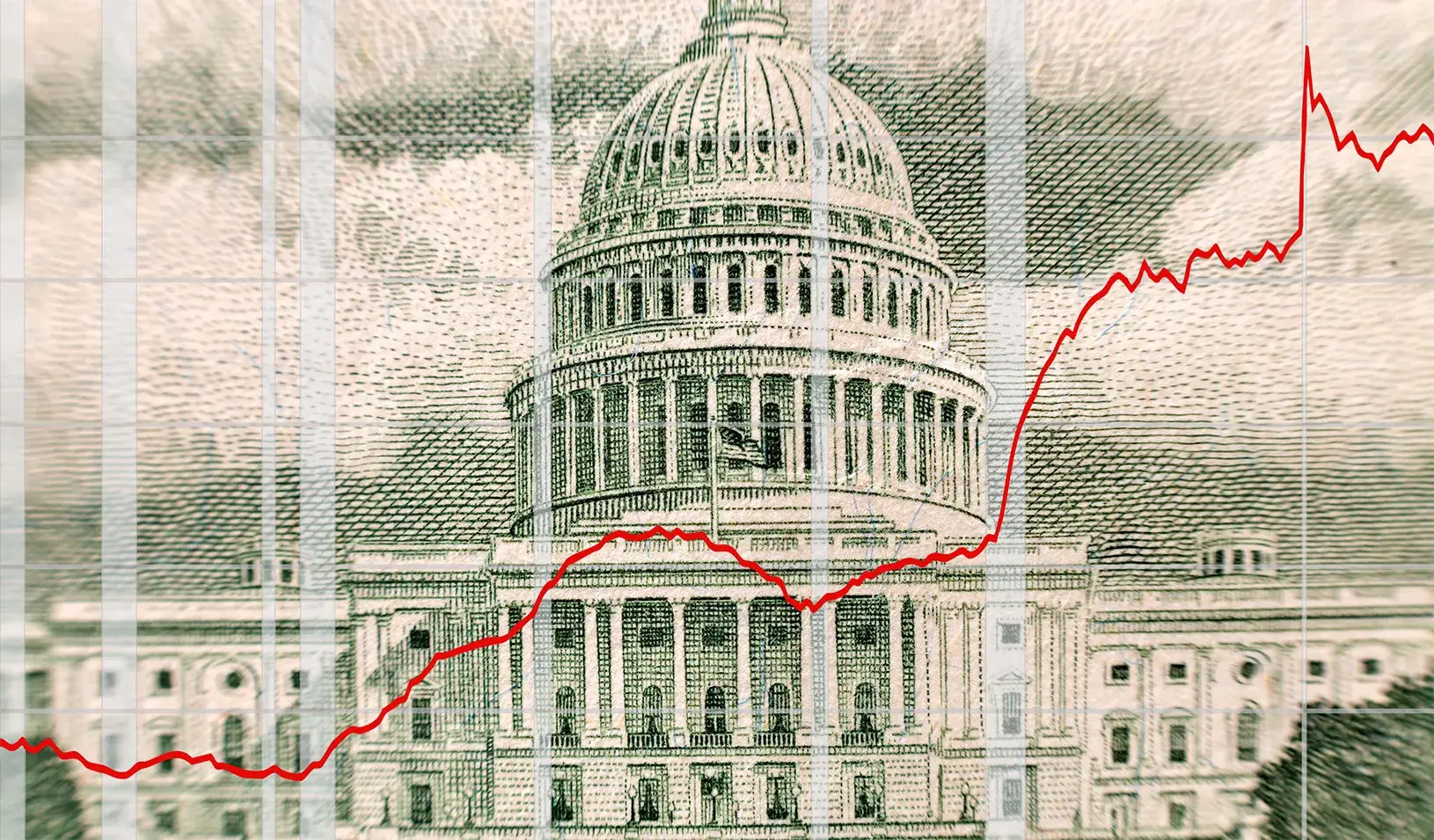

Why Sanctions Failed to Restrain Russia’s Oligarchs

Companies facing international restrictions stay alive by playing a game of “regulatory arbitrage.”

Here’s the Best Way to Sell a Hot Rotisserie Chicken

Many grocery stores are doing it all wrong. It’s better to move the freshest food to the front of the shelf.