Program List for Testing TBD Programs

Regular Faculty List

Faculty with Twitters

Faculty with Blogs

Create a preformatted list of various content types by selecting from a number of criteria and choosing the number of items to display in your list.

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Skylo: Course Correcting Mid Launch

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Interscope: Leveraging the Flywheel to Build the Music Company of the Future

This case explores how John Janick, CEO of Interscope Records, used strategic communication to align a rapidly growing creative organization and clarify its value to multiple audiences in a highly disrupted industry. As artists gained unprecedented…

The All Aboard Fund: A Coalition to Bridge the Missing Middle and Scale Climate Companies

Chris Anderson, best known for scaling TED and mobilizing billions for philanthropy, and Stan Miranda, a career investor who helped build Partners Capital into a $65B outsourced CIO, believe they can unlock one of climate investing’s most persistent…

Impact Engine: The Pursuit of Impact-Weighted Market-Rate Returns

As the CEO and Managing Partner of investment firm Impact Engine, Jessica Droste Yagan had grown accustomed to pushing the boundaries of impact. For over a decade, she had overseen multiple efforts to redefine what it meant to be an impact investor, where…

Databricks: Professional Services, the Key to Unlocking Consumption

Becoming a Platform Company: How Ingram Micro Disrupted Itself

This case presents Ingram Micro’s effort to reimagine the IT distribution model through Xvantage, an AI-enabled digital platform launched as the company prepared to return to public markets. In the case, CEO Paul Bay, Chief Digital Officer Sanjib Sahoo…

Lunar Labs: Engineering Its Own Evolution

Alex Tiller, Captain of Lunar Labs, faces a defining moment for his organization’s experimental model of innovation. During a Quarterly Learning Review, the team behind CarbonCatcher—a direct air capture project designed to remove carbon from the…

Eleven Software

In 2022, two first-time entrepreneurs, Hannah Greenberg and Alex Lopez, acquired Eleven Software, a Portland-based provider of cloud platforms that managed guest Wi-Fi for major hospitality brands such as Hilton and Marriott. The pair had met during their…

Nuveen and CleanPlanet: Evaluating a Private Equity Impact Investment

For nearly a year, Ted Maa and Chris Steinbaugh, members of the Private Equity Impact Investing team at Nuveen, had been following a potential investment opportunity for a company raising $30 million that had only recently fallen out of exclusivity. The…

Addendum to Builders Fund: Impact Prioritization Rating

For ten weeks, the Spring 2024 cohort of students in ALP-303: Analysis and Measurement of Impact at the Stanford Graduate School of Business tackled an initial attempt at improving the Builders Fund (“Builders”) Impact Prioritization Rating (IPR). As part…

Simon de Montfort – SeaGlider

In 2025, serial entrepreneur and angel investor Simon de Montfort stepped into an unassuming warehouse in Alameda, California, to meet Ricky Jennings, the inventor behind SeaGlider—an ambitious effort to build autonomous, wind- and solar-powered ocean…

Deutsche Telekom in 2025: The Dancing Elephant in the Age of AI

Deutsche Telekom (DT) reached an unprecedented peak of success in 2025, becoming the world’s most valuable telco brand and the leading European telco by market capitalization. This standing was symbolized by the “Dancing Elephant” sculpture at its Bonn…

Keep Rowing: Sami Inkinen and Virta Health

In 2025, Virta Health CEO and cofounder Sami Inkinen faces a series of strategic and leadership choices as the company nears profitability and contemplates an initial public offering (IPO). Founded in 2014 to reverse Type 2 diabetes and obesity through…

MECCA: Empowering Customers to Look, Feel, and Be Their Best

MECCA had by 2025 become Australasia’s leading prestige beauty retailer, with a 30 percent market share, annual revenues exceeding A$1.2 billion, and a passionate following of four million customers. The company was founded in 1997 by Jo Horgan with a…

Innovation and Adversity: The Implementation of a United Federal Electronic Health Record for U.S. Veterans

Electronic health records (EHR) offer clear efficiency, productivity, and safety benefits to health care organizations, medical personnel, and patients. Implementing an EHR modernization program throughout the Department of Veterans Affairs (VA) health…

Bonnier News in 2025: Engineering the Future of Media

Bonnier News in 2025 had solidified its position as Sweden’s leading news provider and the Nordic region’s largest news media group, largely through a successful strategic and operating model transformation. Under CEO Anders Eriksson, the company…

Autodesk in 2025: Reimagining the Future with AI

In mid-2025, eight years into his tenure as CEO, Andrew Anagnost is navigating Autodesk through its most rapid period of change, driven by three strategic vectors: optimizing its go-to-market function, growing new “design and make” businesses, and…

WeWork: From Unicorn to Bankruptcy

WeWork, once one of the most valuable start-ups in history, filed for Chapter 11 bankruptcy protection in November 2023. An innovator in the commercial real estate space, WeWork developed a “space-as-a-service” model, offering an increasingly mobile…

Cummins Inc. in 2025: Navigating the Bumpy Road to Destination Zero

In 2025, Cummins Inc., a global transportation systems leader, was navigating a complex energy transition guided by its Destination Zero strategy, which aimed for net-zero emissions by 2050. The company faced a dual imperative: driving profitability in…

JetBlue Ventures in 2025: From CVC to VC

JetBlue Ventures is the corporate venture capital arm of JetBlue Airways. The case describes the evolution and growth path of JetBlue Ventures as it used its investment team and operations team to successfully invest in 53 start-ups over 8 years. It…

Meta and Political Speech

WEX: Leading Product Strategy Transformation

The U.S. Olympic Committee and the Larry Nassar Sexual Abuse Crisis

In late 2017, the sexual abuse scandal involving USA Gymnastics team physician Larry Nassar appeared to be winding down. Nassar had pleaded guilty to federal and state charges, and key figures, including USA Gymnastics CEO Steve Penny, had resigned. A new…

Working Papers: Multiple Criteria

This list lets you select Working Papers to display, and how many to display. The default is three. You can filter your list using one or more of the following: node IDs, faculty author, academic area, additional topics, CIRCLE, keywords.

Working Papers - Compact

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Working Papers - Expanded

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

ACT Projects: Multiple Criteria

This list, used in the Alumni ACT section, lets you select ACT projects to display, and how many to display. The default is three. You can filter your list using one or more of the following: node IDs, status, project type, project focus, organization type. In addition you can select one or more of these fields to display: organization location, URL, project locations, project type, project focus, organization type.

Cost Analysis, Full Team Projects

ACE Charter Schools

AchieveKids II

Acterra

Acterra: Action for a Healthy Planet V

Acterra: Action for a Healthy Planet VI

Ada’s Café

African American Community Service Agency

Alisa Ann Ruch Burn Foundation

Almaden Country Day School II

Almaden Country School

Alternative Family Services

Ambition Angels

American Conservatory Theater

American Farmland Trust

American Red Cross, Palo Alto Chapter

Avenidas II

Bay Area Ridge Trail Council

Bay Area Ridge Trail Council

Bay Area Ridge Trail Council II

Bay Area Tutoring Association

Breakthrough Collaborative

Breakthrough Collaborative II

Bring Change 2 Mind II

Business United in Investing, Lending and Developing (BUILD)

All Stories: Multiple Criteria

This list lets you select stories written by Marketing, and how many to display. The default is 10. The type of story (announcement, idea story, etc.) is a required field. You can filter your list using one or more of the following: title link, keyword, center & research program, alumni program, promoted in Re:Think, academic area, additional topics, region of interest.

Stories - Compact View (No Media Mentions)

Scholars Discuss the Promises and Challenges of Decentralized Governance

Los Angeles Times

Contributor: Downtowns Are Dying, But We Know How to Save Them

Wall Street Journal

Will the Next Jobs Report Reveal the Real Cost of AI on Employment?

CNN Business

Amazon’s Layoffs Are Staggering. We’ve Seen This Before.

Wall Street Journal

A Weaker Dollar Has Always Been Part of Trump’s Plan

USA Today

Who is Trump's Pick to Lead the Fed? What to Know About Kevin Warsh

The Economist

Why Is the Yen Still So Weak?

Spurring Startup Success: Celebrating Thirty Years of CES

Marketing Science Pioneer David “Dave” Montgomery Dies at Age 87

Charles Bonini, a Guiding Hand for Stanford GSB’s Executive Education and MBA Programs, Dies at 91

“The Next Century of Business Leadership Begins Here”

Poets&Quants

2025 MBA Best In Class Award for Entrepreneurship: Stanford Graduate School of Business

Gabriela Forter Miranda, MBA ’24: Filling the “Missing Middle” in Mental Health Services

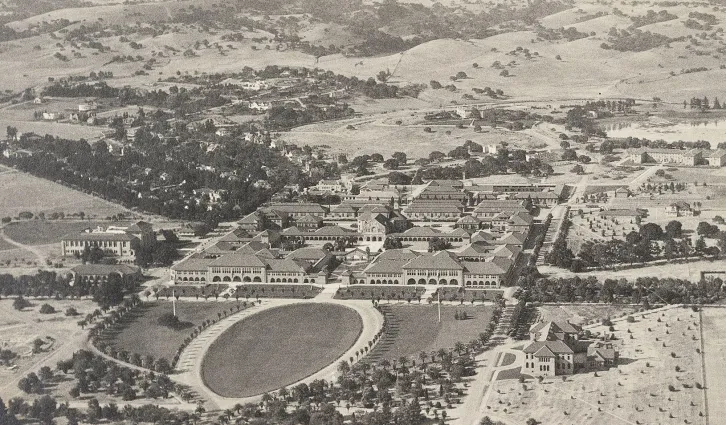

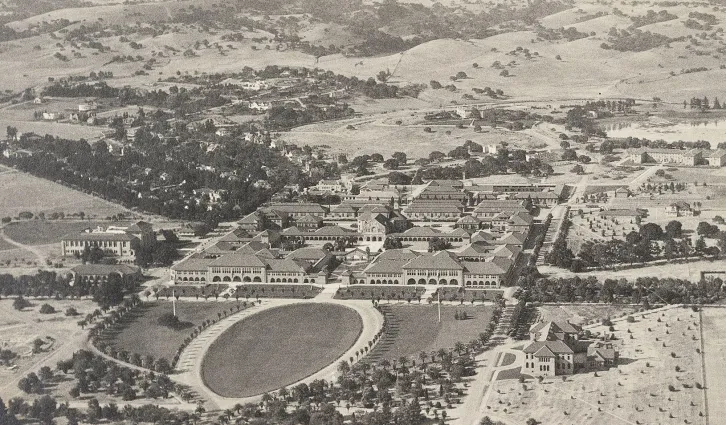

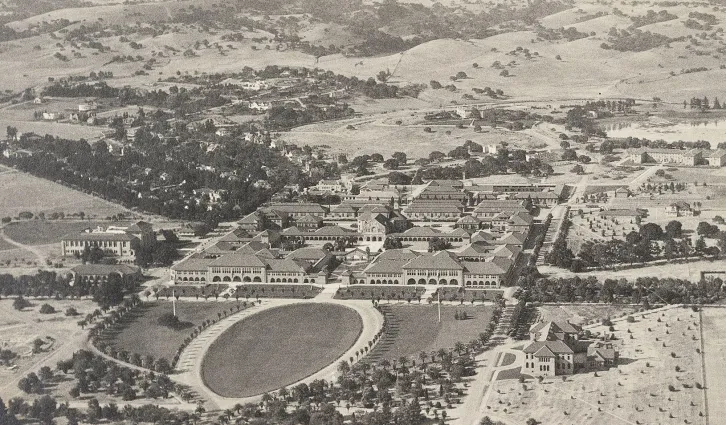

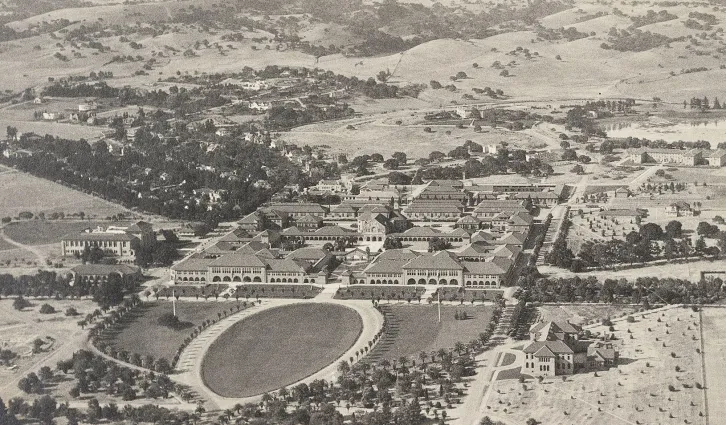

Stanford GSB and the School of Engineering: A Shared Century of Innovation

Quantifying Stanford GSB’s Founder Effect

10 of Our Top Stories from the Stanford GSB Centennial

Marketplace Radio

How Are Retailers Benefiting from the "Buy Now, Pay Later" Boom?

San Francisco Chronicle

Insurance Denied to Nonsmoker Lung Cancer Expert Who Has the Disease

Financial Times

New Finance Needs a New Kind of Treasury Note

Financial Times11/29/2025

OpenAI’s Lead Under Pressure as Rivals Start to Close the Gap

Project Syndicate

Will 2026 Bring Financial Crisis?

NBC Bay Area

Stanford GSB at 100

“Learning Here Isn’t Just About Ideas”

Fast Company

Can Business Schools Really Prepare Students for a World of AI? Stanford Thinks So

Stories - Expanded View (No Media Mentions)

Scholars Discuss the Promises and Challenges of Decentralized Governance

Los Angeles Times

Contributor: Downtowns Are Dying, But We Know How to Save Them

Wall Street Journal

Will the Next Jobs Report Reveal the Real Cost of AI on Employment?

CNN Business

Amazon’s Layoffs Are Staggering. We’ve Seen This Before.

Wall Street Journal

A Weaker Dollar Has Always Been Part of Trump’s Plan

USA Today

Who is Trump's Pick to Lead the Fed? What to Know About Kevin Warsh

The Economist

Why Is the Yen Still So Weak?

Spurring Startup Success: Celebrating Thirty Years of CES

Marketing Science Pioneer David “Dave” Montgomery Dies at Age 87

Charles Bonini, a Guiding Hand for Stanford GSB’s Executive Education and MBA Programs, Dies at 91

“The Next Century of Business Leadership Begins Here”

Poets&Quants

2025 MBA Best In Class Award for Entrepreneurship: Stanford Graduate School of Business

Gabriela Forter Miranda, MBA ’24: Filling the “Missing Middle” in Mental Health Services

Stanford GSB and the School of Engineering: A Shared Century of Innovation

Quantifying Stanford GSB’s Founder Effect

10 of Our Top Stories from the Stanford GSB Centennial

Marketplace Radio

How Are Retailers Benefiting from the "Buy Now, Pay Later" Boom?

San Francisco Chronicle

Insurance Denied to Nonsmoker Lung Cancer Expert Who Has the Disease

Financial Times

New Finance Needs a New Kind of Treasury Note

Financial Times11/29/2025

OpenAI’s Lead Under Pressure as Rivals Start to Close the Gap

Project Syndicate

Will 2026 Bring Financial Crisis?

NBC Bay Area

Stanford GSB at 100

“Learning Here Isn’t Just About Ideas”

Fast Company

Can Business Schools Really Prepare Students for a World of AI? Stanford Thinks So

Media Mentions - Expanded

Scholars Discuss the Promises and Challenges of Decentralized Governance

Los Angeles Times

Contributor: Downtowns Are Dying, But We Know How to Save Them

Wall Street Journal

Will the Next Jobs Report Reveal the Real Cost of AI on Employment?

CNN Business

Amazon’s Layoffs Are Staggering. We’ve Seen This Before.

Wall Street Journal

A Weaker Dollar Has Always Been Part of Trump’s Plan

USA Today

Who is Trump's Pick to Lead the Fed? What to Know About Kevin Warsh

The Economist

Why Is the Yen Still So Weak?

Spurring Startup Success: Celebrating Thirty Years of CES

Marketing Science Pioneer David “Dave” Montgomery Dies at Age 87

Charles Bonini, a Guiding Hand for Stanford GSB’s Executive Education and MBA Programs, Dies at 91

“The Next Century of Business Leadership Begins Here”

Poets&Quants

2025 MBA Best In Class Award for Entrepreneurship: Stanford Graduate School of Business

Gabriela Forter Miranda, MBA ’24: Filling the “Missing Middle” in Mental Health Services

Stanford GSB and the School of Engineering: A Shared Century of Innovation

Quantifying Stanford GSB’s Founder Effect

10 of Our Top Stories from the Stanford GSB Centennial

Marketplace Radio

How Are Retailers Benefiting from the "Buy Now, Pay Later" Boom?

San Francisco Chronicle

Insurance Denied to Nonsmoker Lung Cancer Expert Who Has the Disease

Financial Times

New Finance Needs a New Kind of Treasury Note

Financial Times11/29/2025

OpenAI’s Lead Under Pressure as Rivals Start to Close the Gap

Project Syndicate

Will 2026 Bring Financial Crisis?

NBC Bay Area

Stanford GSB at 100

“Learning Here Isn’t Just About Ideas”

Fast Company

Can Business Schools Really Prepare Students for a World of AI? Stanford Thinks So

Books: Multiple Criteria

This list lets you select Books to display, and how many to display. The default is three. You can filter your list using one or more of the following: node IDs, faculty author, academic area, additional topics, CIRCLE, keywords.

Finance Books - Compact

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Finance Books - Expanded

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Cases: Multiple Criteria

This list lets you select Cases to display, and how many to display. The default is 10. You can filter your list using one or more of the following: node IDs, academic area, business Insight topic, keywords.

Nonprofit Cases - Compact

Skylo: Course Correcting Mid Launch

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Interscope: Leveraging the Flywheel to Build the Music Company of the Future

This case explores how John Janick, CEO of Interscope Records, used strategic communication to align a rapidly growing creative organization and clarify its value to multiple audiences in a highly disrupted industry. As artists gained unprecedented…

The All Aboard Fund: A Coalition to Bridge the Missing Middle and Scale Climate Companies

Chris Anderson, best known for scaling TED and mobilizing billions for philanthropy, and Stan Miranda, a career investor who helped build Partners Capital into a $65B outsourced CIO, believe they can unlock one of climate investing’s most persistent…

Impact Engine: The Pursuit of Impact-Weighted Market-Rate Returns

As the CEO and Managing Partner of investment firm Impact Engine, Jessica Droste Yagan had grown accustomed to pushing the boundaries of impact. For over a decade, she had overseen multiple efforts to redefine what it meant to be an impact investor, where…

Databricks: Professional Services, the Key to Unlocking Consumption

Becoming a Platform Company: How Ingram Micro Disrupted Itself

This case presents Ingram Micro’s effort to reimagine the IT distribution model through Xvantage, an AI-enabled digital platform launched as the company prepared to return to public markets. In the case, CEO Paul Bay, Chief Digital Officer Sanjib Sahoo…

Lunar Labs: Engineering Its Own Evolution

Alex Tiller, Captain of Lunar Labs, faces a defining moment for his organization’s experimental model of innovation. During a Quarterly Learning Review, the team behind CarbonCatcher—a direct air capture project designed to remove carbon from the…

Eleven Software

In 2022, two first-time entrepreneurs, Hannah Greenberg and Alex Lopez, acquired Eleven Software, a Portland-based provider of cloud platforms that managed guest Wi-Fi for major hospitality brands such as Hilton and Marriott. The pair had met during their…

Nuveen and CleanPlanet: Evaluating a Private Equity Impact Investment

For nearly a year, Ted Maa and Chris Steinbaugh, members of the Private Equity Impact Investing team at Nuveen, had been following a potential investment opportunity for a company raising $30 million that had only recently fallen out of exclusivity. The…

Addendum to Builders Fund: Impact Prioritization Rating

For ten weeks, the Spring 2024 cohort of students in ALP-303: Analysis and Measurement of Impact at the Stanford Graduate School of Business tackled an initial attempt at improving the Builders Fund (“Builders”) Impact Prioritization Rating (IPR). As part…

Simon de Montfort – SeaGlider

In 2025, serial entrepreneur and angel investor Simon de Montfort stepped into an unassuming warehouse in Alameda, California, to meet Ricky Jennings, the inventor behind SeaGlider—an ambitious effort to build autonomous, wind- and solar-powered ocean…

Deutsche Telekom in 2025: The Dancing Elephant in the Age of AI

Deutsche Telekom (DT) reached an unprecedented peak of success in 2025, becoming the world’s most valuable telco brand and the leading European telco by market capitalization. This standing was symbolized by the “Dancing Elephant” sculpture at its Bonn…

Keep Rowing: Sami Inkinen and Virta Health

In 2025, Virta Health CEO and cofounder Sami Inkinen faces a series of strategic and leadership choices as the company nears profitability and contemplates an initial public offering (IPO). Founded in 2014 to reverse Type 2 diabetes and obesity through…

MECCA: Empowering Customers to Look, Feel, and Be Their Best

MECCA had by 2025 become Australasia’s leading prestige beauty retailer, with a 30 percent market share, annual revenues exceeding A$1.2 billion, and a passionate following of four million customers. The company was founded in 1997 by Jo Horgan with a…

Innovation and Adversity: The Implementation of a United Federal Electronic Health Record for U.S. Veterans

Electronic health records (EHR) offer clear efficiency, productivity, and safety benefits to health care organizations, medical personnel, and patients. Implementing an EHR modernization program throughout the Department of Veterans Affairs (VA) health…

Bonnier News in 2025: Engineering the Future of Media

Bonnier News in 2025 had solidified its position as Sweden’s leading news provider and the Nordic region’s largest news media group, largely through a successful strategic and operating model transformation. Under CEO Anders Eriksson, the company…

Autodesk in 2025: Reimagining the Future with AI

In mid-2025, eight years into his tenure as CEO, Andrew Anagnost is navigating Autodesk through its most rapid period of change, driven by three strategic vectors: optimizing its go-to-market function, growing new “design and make” businesses, and…

WeWork: From Unicorn to Bankruptcy

WeWork, once one of the most valuable start-ups in history, filed for Chapter 11 bankruptcy protection in November 2023. An innovator in the commercial real estate space, WeWork developed a “space-as-a-service” model, offering an increasingly mobile…

Cummins Inc. in 2025: Navigating the Bumpy Road to Destination Zero

In 2025, Cummins Inc., a global transportation systems leader, was navigating a complex energy transition guided by its Destination Zero strategy, which aimed for net-zero emissions by 2050. The company faced a dual imperative: driving profitability in…

JetBlue Ventures in 2025: From CVC to VC

JetBlue Ventures is the corporate venture capital arm of JetBlue Airways. The case describes the evolution and growth path of JetBlue Ventures as it used its investment team and operations team to successfully invest in 53 start-ups over 8 years. It…

Meta and Political Speech

WEX: Leading Product Strategy Transformation

The U.S. Olympic Committee and the Larry Nassar Sexual Abuse Crisis

In late 2017, the sexual abuse scandal involving USA Gymnastics team physician Larry Nassar appeared to be winding down. Nassar had pleaded guilty to federal and state charges, and key figures, including USA Gymnastics CEO Steve Penny, had resigned. A new…

Nonprofit Cases - Expanded

Skylo: Course Correcting Mid Launch

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Interscope: Leveraging the Flywheel to Build the Music Company of the Future

This case explores how John Janick, CEO of Interscope Records, used strategic communication to align a rapidly growing creative organization and clarify its value to multiple audiences in a highly disrupted industry. As artists gained unprecedented…

The All Aboard Fund: A Coalition to Bridge the Missing Middle and Scale Climate Companies

Chris Anderson, best known for scaling TED and mobilizing billions for philanthropy, and Stan Miranda, a career investor who helped build Partners Capital into a $65B outsourced CIO, believe they can unlock one of climate investing’s most persistent…

Impact Engine: The Pursuit of Impact-Weighted Market-Rate Returns

As the CEO and Managing Partner of investment firm Impact Engine, Jessica Droste Yagan had grown accustomed to pushing the boundaries of impact. For over a decade, she had overseen multiple efforts to redefine what it meant to be an impact investor, where…

Databricks: Professional Services, the Key to Unlocking Consumption

Becoming a Platform Company: How Ingram Micro Disrupted Itself

This case presents Ingram Micro’s effort to reimagine the IT distribution model through Xvantage, an AI-enabled digital platform launched as the company prepared to return to public markets. In the case, CEO Paul Bay, Chief Digital Officer Sanjib Sahoo…

Lunar Labs: Engineering Its Own Evolution

Alex Tiller, Captain of Lunar Labs, faces a defining moment for his organization’s experimental model of innovation. During a Quarterly Learning Review, the team behind CarbonCatcher—a direct air capture project designed to remove carbon from the…

Eleven Software

In 2022, two first-time entrepreneurs, Hannah Greenberg and Alex Lopez, acquired Eleven Software, a Portland-based provider of cloud platforms that managed guest Wi-Fi for major hospitality brands such as Hilton and Marriott. The pair had met during their…

Nuveen and CleanPlanet: Evaluating a Private Equity Impact Investment

For nearly a year, Ted Maa and Chris Steinbaugh, members of the Private Equity Impact Investing team at Nuveen, had been following a potential investment opportunity for a company raising $30 million that had only recently fallen out of exclusivity. The…

Addendum to Builders Fund: Impact Prioritization Rating

For ten weeks, the Spring 2024 cohort of students in ALP-303: Analysis and Measurement of Impact at the Stanford Graduate School of Business tackled an initial attempt at improving the Builders Fund (“Builders”) Impact Prioritization Rating (IPR). As part…

Simon de Montfort – SeaGlider

In 2025, serial entrepreneur and angel investor Simon de Montfort stepped into an unassuming warehouse in Alameda, California, to meet Ricky Jennings, the inventor behind SeaGlider—an ambitious effort to build autonomous, wind- and solar-powered ocean…

Deutsche Telekom in 2025: The Dancing Elephant in the Age of AI

Deutsche Telekom (DT) reached an unprecedented peak of success in 2025, becoming the world’s most valuable telco brand and the leading European telco by market capitalization. This standing was symbolized by the “Dancing Elephant” sculpture at its Bonn…

Keep Rowing: Sami Inkinen and Virta Health

In 2025, Virta Health CEO and cofounder Sami Inkinen faces a series of strategic and leadership choices as the company nears profitability and contemplates an initial public offering (IPO). Founded in 2014 to reverse Type 2 diabetes and obesity through…

MECCA: Empowering Customers to Look, Feel, and Be Their Best

MECCA had by 2025 become Australasia’s leading prestige beauty retailer, with a 30 percent market share, annual revenues exceeding A$1.2 billion, and a passionate following of four million customers. The company was founded in 1997 by Jo Horgan with a…

Innovation and Adversity: The Implementation of a United Federal Electronic Health Record for U.S. Veterans

Electronic health records (EHR) offer clear efficiency, productivity, and safety benefits to health care organizations, medical personnel, and patients. Implementing an EHR modernization program throughout the Department of Veterans Affairs (VA) health…

Bonnier News in 2025: Engineering the Future of Media

Bonnier News in 2025 had solidified its position as Sweden’s leading news provider and the Nordic region’s largest news media group, largely through a successful strategic and operating model transformation. Under CEO Anders Eriksson, the company…

Autodesk in 2025: Reimagining the Future with AI

In mid-2025, eight years into his tenure as CEO, Andrew Anagnost is navigating Autodesk through its most rapid period of change, driven by three strategic vectors: optimizing its go-to-market function, growing new “design and make” businesses, and…

WeWork: From Unicorn to Bankruptcy

WeWork, once one of the most valuable start-ups in history, filed for Chapter 11 bankruptcy protection in November 2023. An innovator in the commercial real estate space, WeWork developed a “space-as-a-service” model, offering an increasingly mobile…

Cummins Inc. in 2025: Navigating the Bumpy Road to Destination Zero

In 2025, Cummins Inc., a global transportation systems leader, was navigating a complex energy transition guided by its Destination Zero strategy, which aimed for net-zero emissions by 2050. The company faced a dual imperative: driving profitability in…

JetBlue Ventures in 2025: From CVC to VC

JetBlue Ventures is the corporate venture capital arm of JetBlue Airways. The case describes the evolution and growth path of JetBlue Ventures as it used its investment team and operations team to successfully invest in 53 start-ups over 8 years. It…

Meta and Political Speech

WEX: Leading Product Strategy Transformation

The U.S. Olympic Committee and the Larry Nassar Sexual Abuse Crisis

In late 2017, the sexual abuse scandal involving USA Gymnastics team physician Larry Nassar appeared to be winding down. Nassar had pleaded guilty to federal and state charges, and key figures, including USA Gymnastics CEO Steve Penny, had resigned. A new…

Clubs: Node ID | Category

This list lets you select Clubs to display, and how many to display. The default is three. You can filter using the node ID or a term that describes the Club category.

Events: Multiple Criteria

This list lets you select upcoming Events to display, and how many to display. The default is three. You can filter your list using one or more of the following: admission events, topics, type of event, region, target audience, event series, keywords.

Upcoming Events - Compact

Thursday, February 26, 2026

Monday, March 09, 2026

Thursday, March 12, 2026

Friday, March 13, 2026

Saturday, March 14, 2026

Monday, March 23, 2026

Wednesday, March 25, 2026

Thursday, April 02, 2026

Friday, April 10, 2026

Wednesday, April 15, 2026

Wednesday, April 29, 2026

Saturday, May 02, 2026

Monday, May 04, 2026

Friday, May 08, 2026

Thursday, May 14, 2026

Monday, May 18, 2026

Wednesday, May 27, 2026

Monday, June 01, 2026

Tuesday, June 02, 2026

Thursday, June 04, 2026

Upcoming Events - Expanded

Thursday, February 26, 2026

Monday, March 09, 2026

Thursday, March 12, 2026

Friday, March 13, 2026

Saturday, March 14, 2026

Monday, March 23, 2026

Wednesday, March 25, 2026

Thursday, April 02, 2026

Friday, April 10, 2026

Wednesday, April 15, 2026

Wednesday, April 29, 2026

Saturday, May 02, 2026

Monday, May 04, 2026

Friday, May 08, 2026

Thursday, May 14, 2026

Monday, May 18, 2026

Wednesday, May 27, 2026

Monday, June 01, 2026

Tuesday, June 02, 2026

Thursday, June 04, 2026

Faculty: Multiple Criteria

This list lets you select Faculty to display. You can list all faculty, or filter your list using one or more of the following: academic area, rank, CIRCLE affiliation, keywords. In addition you can display the name alone or with academic area and/or rank.

CSI Faculty

Publications: Multiple Criteria

This list lets you select Publications (JABCO) to display, and how many to display. The default is three. You can filter your list using one or more of the following: node IDs, publication type, faculty author, academic area, additional topics, region of interest, center, keywords.

Accounting Journal Articles - Compact

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Accounting Journal Articles - Expanded

Seeing Green: The Effects of Financial Exposures on Support for Climate Action

Despite the large common net benefits of climate mitigation, broad-based political consensus for large-scale policy action remains elusive. We hypothesize that financial exposure to energy stocks central to the green transition can induce…

Firm Climate Investment: A Glass Half-full

The green transition will require large investments from firms, yet little is known about the scale and drivers of climate-related capital expenditure across the UK economy. To address this gap, we draw on a large, representative survey of UK…

Manufacturing Risk-Free Government Debt

When debt is priced fairly, governments face a trade-off between insuring bondholders and taxpayers. If the government decides to fully insure bondholders by manufacturing risk-free debt, then it cannot insure taxpayers against permanent macro-…

A Breach in the Great Wall: Why Are Chinese Companies Listed in the U.S. Subject to Lower Disclosure Standards?

Over the years, the U.S. Securities and Exchange Commission (SEC) has exempted foreign private issuers (FPIs)—foreign companies traded on U.S. exchanges—from certain U.S. securities laws in order to attract high-quality companies from companies…

Exploring the Characteristics Associated With Diabetes and Hypertension Performance in Community Health Centers

Roadmap or Compass? The Value of Prior Collaborative Experience in an Unfamiliar Task Environment

When a temporary team faces an unfamiliar task environment, it should particularly benefit from including members who have collaborated before. Although several studies have made this prediction, it has not been supported empirically. We…

The Assignment of Intellectual Property Rights and Innovation

We study how the assignment of intellectual property rights between inventors and their employers affects innovation. Incomplete contracting theories predict that stronger employer property rights reduce the threat that employee inventors hold up…

A Registered Report Megastudy on the Persuasiveness of the Most-cited Climate Messages

It is important to understand how persuasive the most-cited climate change messaging strategies are. In five replication studies, we found limited evidence of persuasive effects of three highly cited strategies (N = 3,216). We then…

Do Coercive Liability-Management Exercises Destroy Firm Value?

Over the past several years, the utilization of liability-management exercises (LMEs) as financial restructuring strategies for overleveraged companies in the U.S. has exploded, taking share from conventional bankruptcies and workouts. The use of…

From Local Knowledge to Global Patterns: A Cross-cultural Study of the Dimensions of Hazards and Adaptive Capacity

Understanding the human impacts of environmental hazards is a growing concern. While there is a plethora of research on climate adaptation, the literature is highly fragmented, and empirical studies are rarely carried out with global samples.…

Intermediation via Credit Chains

The modern financial system features complicated intermediation chains, with each layer performing some degree of credit/maturity transformation. We develop a dynamic model where an ultimate borrower obtains funds from overlappinggeneration…

Policy News and Stock Market Volatility

We use newspapers to create Equity Market Volatility (EMV) trackers at daily and monthly frequencies. Our headline EMV tracker moves closely with the VIX and the S&P500 returns volatility in and out of sample. We exploit the volume of…

Politics and Policy Where State Capacity is Low

Governments define and protect property rights, which facilitate investment, regulate economic activities to manage externalities, and provide the public goods and services necessary for a healthy, educated and…

Why do people choose extreme candidates? The role of identity relevance

Elected officials are increasingly extreme. Research trying to understand this trend has tended to focus on structural factors, such as primary elections and changes in the supply of candidates. Less emphasis has been placed on psychological…

Fifteen reasons you should read this paper: How providing many arguments increases perceptions of both expertise and persuasive intent

People generally believe more is better in persuasion, for good reason. Past research has shown that providing more arguments can enhance a message’s persuasiveness. In contrast, we demonstrate that increasing the number of…

A Framework for Geoeconomics

Governments use their countries’ economic strength from financial and trade relationships to achieve geopolitical and economic goals. We provide a model of the sources of geoeconomic power and how it is wielded. The source of this power is the…

Introduction to Corporate Governance

Corporate governance has become a well-discussed and controversial topic among corporations, shareholders, and the general public. However, the debate over what constitutes “good governance” often lacks structure, making it difficult for…

Low Rate of Completion of Recommended Tests and Referrals in an Academic Primary Care Practice with Resident Trainees

Background

A frequent, preventable cause of diagnostic errors involves failure to follow up on…

Promoting Equity, Diversity, and Inclusion in Surveys: Insights From a Patient-Engaged Study To Assess Long COVID Healthcare Needs in Brazil

Background and Objective

Long COVID (LC) refers to persistent symptoms after acute COVID-19 infection, which may persist for months or years. LC affects millions of people globally, with substantial impacts on quality of life, employment…

Shared language for health equity: Preferences across the political spectrum

Skylo: Course Correcting Mid Launch

Sports Business Management: Decision Making Around the Globe

This new edition of a widely adopted textbook equips students with a comprehensive understanding of the sport industry. With a focus on management, strategy, marketing and finance, the decision-making approach of the book emphasizes key concepts…

Talking about what we support versus oppose affects others’ openness to our views

People’s unwillingness to engage with others who hold views that differ from their own—in other words, their lack of receptiveness to opposing views—is a growing problem globally. We explore the possibility that something as simple as how people…

Top Corner Capital: Rethinking Venture Debt for the Seed Stage

Programs: Multiple Criteria

Programs

ACT Projects: Multiple Criteria

Cost Analysis, Full Team Projects

ACE Charter Schools

AchieveKids II

Acterra

Acterra: Action for a Healthy Planet V

Acterra: Action for a Healthy Planet VI

Ada’s Café

African American Community Service Agency

Alisa Ann Ruch Burn Foundation

Almaden Country Day School II

Almaden Country School

Alternative Family Services

Ambition Angels

American Conservatory Theater

American Farmland Trust

American Red Cross, Palo Alto Chapter

Avenidas II

Bay Area Ridge Trail Council

Bay Area Ridge Trail Council

Bay Area Ridge Trail Council II

Bay Area Tutoring Association

Breakthrough Collaborative

Breakthrough Collaborative II

Bring Change 2 Mind II

Business United in Investing, Lending and Developing (BUILD)

All Stories: Multiple Criteria

Stories - Compact View

Scholars Discuss the Promises and Challenges of Decentralized Governance

Los Angeles Times

Contributor: Downtowns Are Dying, But We Know How to Save Them

Wall Street Journal

Will the Next Jobs Report Reveal the Real Cost of AI on Employment?

CNN Business

Amazon’s Layoffs Are Staggering. We’ve Seen This Before.

Wall Street Journal

A Weaker Dollar Has Always Been Part of Trump’s Plan

USA Today

Who is Trump's Pick to Lead the Fed? What to Know About Kevin Warsh

The Economist

Why Is the Yen Still So Weak?

Spurring Startup Success: Celebrating Thirty Years of CES

Marketing Science Pioneer David “Dave” Montgomery Dies at Age 87

Charles Bonini, a Guiding Hand for Stanford GSB’s Executive Education and MBA Programs, Dies at 91

“The Next Century of Business Leadership Begins Here”

Poets&Quants

2025 MBA Best In Class Award for Entrepreneurship: Stanford Graduate School of Business

Gabriela Forter Miranda, MBA ’24: Filling the “Missing Middle” in Mental Health Services

Stanford GSB and the School of Engineering: A Shared Century of Innovation

Quantifying Stanford GSB’s Founder Effect

10 of Our Top Stories from the Stanford GSB Centennial

Marketplace Radio

How Are Retailers Benefiting from the "Buy Now, Pay Later" Boom?

San Francisco Chronicle

Insurance Denied to Nonsmoker Lung Cancer Expert Who Has the Disease