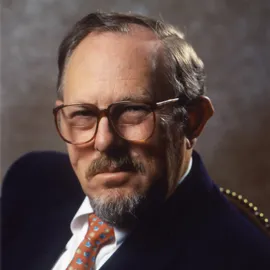

William F. Sharpe

The STANCO 25 Professor of Finance, Emeritus

Research Statement

Bio

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at Irvine. In 1996, he cofounded Financial Engines, a firm that provides online investment advice and management for individuals.

Sharpe was one of the originators of the Capital Asset Pricing Model, developed the Sharpe Ratio for investment performance analysis, the binomial method for the valuation of options, the gradient method for asset allocation optimization, and returns-based style analysis for evaluating the style and performance of investment funds.

Sharpe has published articles in a number of professional journals, including Management Science, The Journal of Business, The Journal of Finance, The Journal of Financial Economics, The Journal of Financial and Quantitative Analysis, The Journal of Portfolio Management, and The Financial Analysts’ Journal.

He has also written seven books, including Portfolio Theory and Capital Markets (McGraw-Hill, 1970 and 2000), Asset Allocation Tools (Scientific Press, 1987), Fundamentals of Investments (with Gordon J. Alexander and Jeffrey Bailey, Prentice-Hall, 2000), Investments (with Gordon J. Alexander and Jeffrey Bailey, Prentice-Hall, 1999) and Investors and Markets, Portfolio Choices, Asset Prices and Investment Advice, Princeton University Press, 2007.

Sharpe is past president of the American Finance Association. In 1990 he received the Nobel Prize in Economic Sciences.

He received his PhD, MA and BA in Economics from the University of California at Los Angeles. He is also the recipient of a Doctor of Humane Letters, Honoris Causa from DePaul University, a Doctor Honoris Causa from the University of Alicante (Spain), a Doctor Honoris Causa from the University of Vienna (Austria), and the UCLA Medal, UCLA’s highest honor.

Academic Degrees

- PhD in Economics, UC Los Angeles, 1961

- MA in Economics, UC Los Angeles, 1956

- BA in Economics, UC Los Angeles, 1955

Academic Appointments

- At Stanford University since 1970, Emeritus since 1999

- Professor, University of California, Irvine, 1968-1970

- Associate Professor, University of Washington, 1961-1968

Professional Experience

- Economist, RAND Corp., 1956-1961

Awards and Honors

- Wharton Jocobs Levy Prize for Quantitative Financial Innovation, 2016

- Nobel Memorial Prize in Economic Science, The Nobel Foundation, 1990

Publications

Journal Articles

Books

Working Papers

Service to the Profession

- Chairman, Financial Engines, Inc

- Past President, American Finance Association