A search fund is an investment vehicle, conceived in 1984, through which investors financially support an entrepreneur’s efforts to locate, acquire, manage, and grow a privately held company.

The model offers relatively inexperienced entrepreneurs with limited capital resources a quick path to managing a company in which they have a meaningful ownership position.

Since 1996, CES has conducted a series of studies on the performance of search funds. CES has identified and tracked more than 600 search funds raised since 1984 in the United States and Canada. The growing cohort of international funds located throughout Western Europe, Latin America, and India are tracked by our counterparts at IESE Business School in Barcelona, Spain.

A 2024 GSB analysis of 681 qualifying search funds in the US and Canada, found the aggregate pre-tax internal rate of return to be 35.1%, and the aggregate pre-tax return on invested capital to be 4.5x.

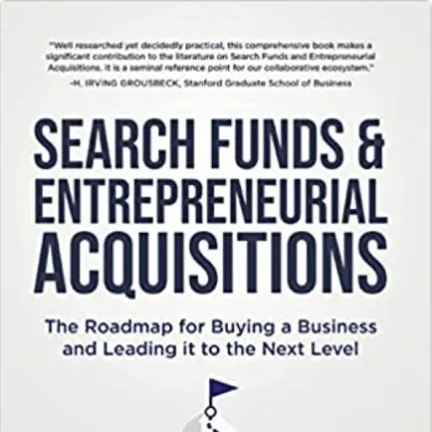

Featured Research

2024 Search Fund Study

The 2024 Search Fund Study reports on the financial returns and key qualities of search funds formed in the United States and Canada since 1984. This…