February 17, 2015

| by Shana LynchFew understand how CEOs get compensated—and that includes the pros.

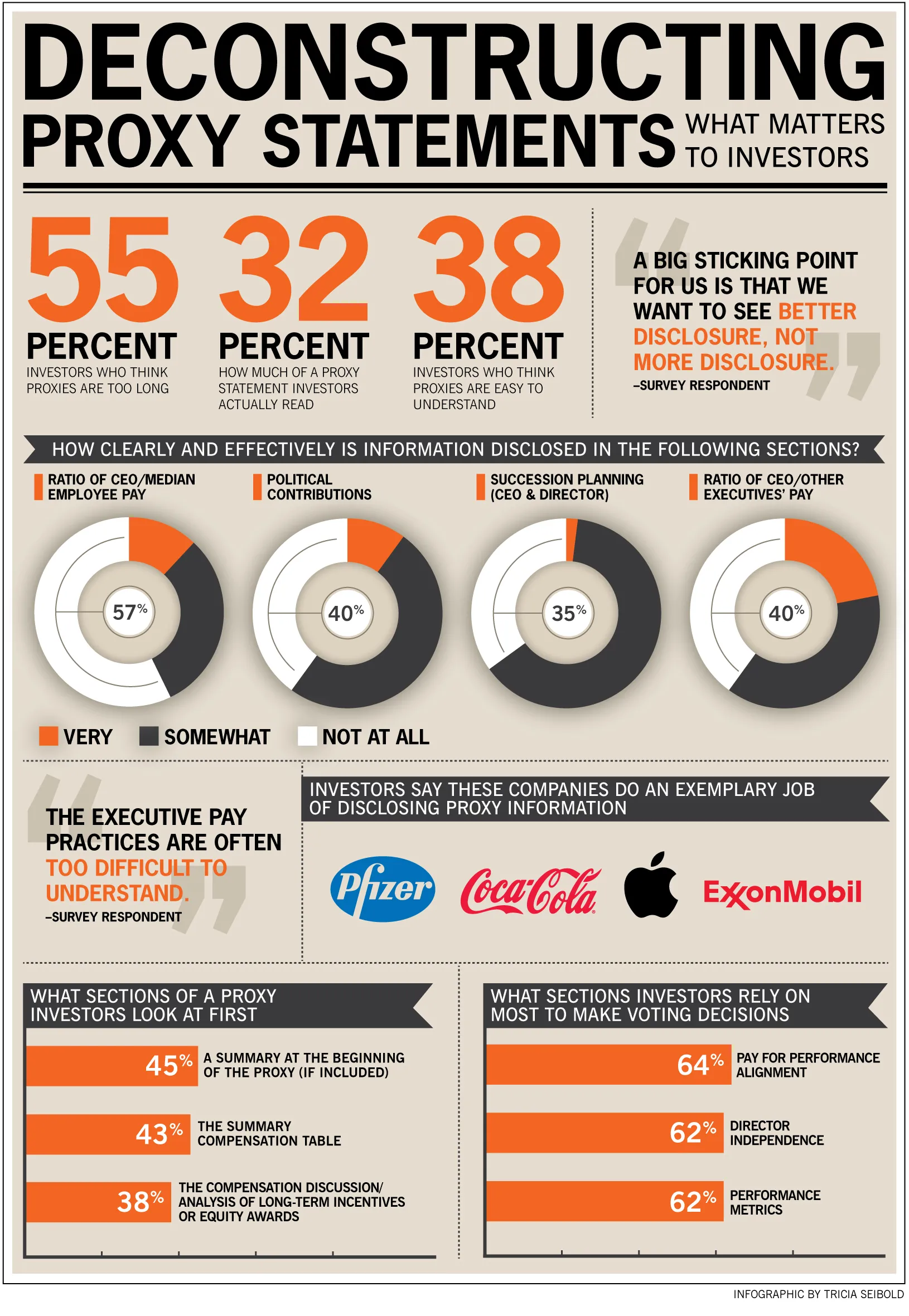

According to new research, institutional investors and pension funds find public company proxies too confusing, particularly when it comes to explaining CEO pay and incentives.

“These are significantly negative perceptions of executive compensation,” says Stanford professor David F. Larcker. “Investors are still frustrated with pay levels overall and whether the packages awarded today are justified.”

Larcker and Brian Tayan of the Corporate Governance Research Initiative surveyed more than 60 professional investors with a combined $17 trillion in assets.

The survey, conducted with RR Donnelly and Equilar, revealed that only 38% of investors believe CEO compensation is clear and effectively disclosed. Some 47% say it’s not clear whether the amount of compensation is appropriate.

More than a quarter of respondents say they don’t understand the relationship between pay and performance.

In general, investors also find proxies too cumbersome. Fifty-five percent think the average proxy is too long (and they only read about a third of it, anyway).

Read the full report, then see the results at a glance below.

Companies, learn how to write the perfect proxy.

For media inquiries, visit the Newsroom.