Online Course Advances Awareness of Retirement Planning and Pensions

Massive open online course led by Finance Professor Joshua Rauh extends the reach of Stanford Graduate School of Business.

February 03, 2014

Josh Rauh | Photo courtesy of Nancy Rothstein

The first massive open online course (MOOC) created and run by Stanford Graduate School of Business — called The Finance of Retirement and Pensions — concluded on January 24, 2014, with a live symposium on the Stanford campus featuring top-performing teams from the course’s final project.

This concluding event was just one of the unique aspects of the course, which sought to educate the general public about the fundamental financial principles that underpin sound retirement planning, as well as illuminate the looming crisis in public pensions.

The course was led by Stanford Graduate School of Business Finance Professor Joshua Rauh, one of the nation’s leading experts on the subject of public finance. “Professor Rauh has changed the national debate about the impending pension crisis,” observed Stanford faculty member Peter DeMarzo, who also serves as faculty director of educational technology at Stanford GSB, during the closing symposium event.

The course was part of the school’s broader initiative to explore the most productive ways to use educational technology, including ways to reach beyond Stanford GSB’s physical campus. As Rauh remarked during the concluding event, “We achieved our goal to reach people who are planning their own retirement and inform them about public policy surrounding this issue, particularly the ways in which public pension problems are threatening to eat away at vital public services, and the corresponding impact on taxpayers.”

The 8-week course, which attracted more than 44,000 registrants, featured 73 separate video lectures that were viewed over 225,000 times. Each video was viewed 3,000 to 5,000 times, representing a 100-times increase in reach over on-campus courses, observed DeMarzo at the symposium. Meanwhile, Rauh’s live webcasts with retirement and pension experts were viewed more than 9,000 times.

The course revealed a marked improvement in understanding about the financial concepts related to retirement planning, as demonstrated by surveys taken at the middle and end of the course. By the end of the course, an overwhelming majority of survey respondents felt better prepared for retirement:

- 89% agreed that they knew how much to save in order to retire at their desired age (up from 74% at the midpoint of the course)

- 84% agreed that they had a sound strategy on how to spend money during retirement (up from 59%)

- 86% agreed that they had a sound strategy for allocating assets (up from 59%)

- 93% agreed that they felt more confident that they would have enough saved to live comfortably during retirement (up from 82%)

The percent of participants who felt they had a sound strategy for allocating investments increased by 26.9%.

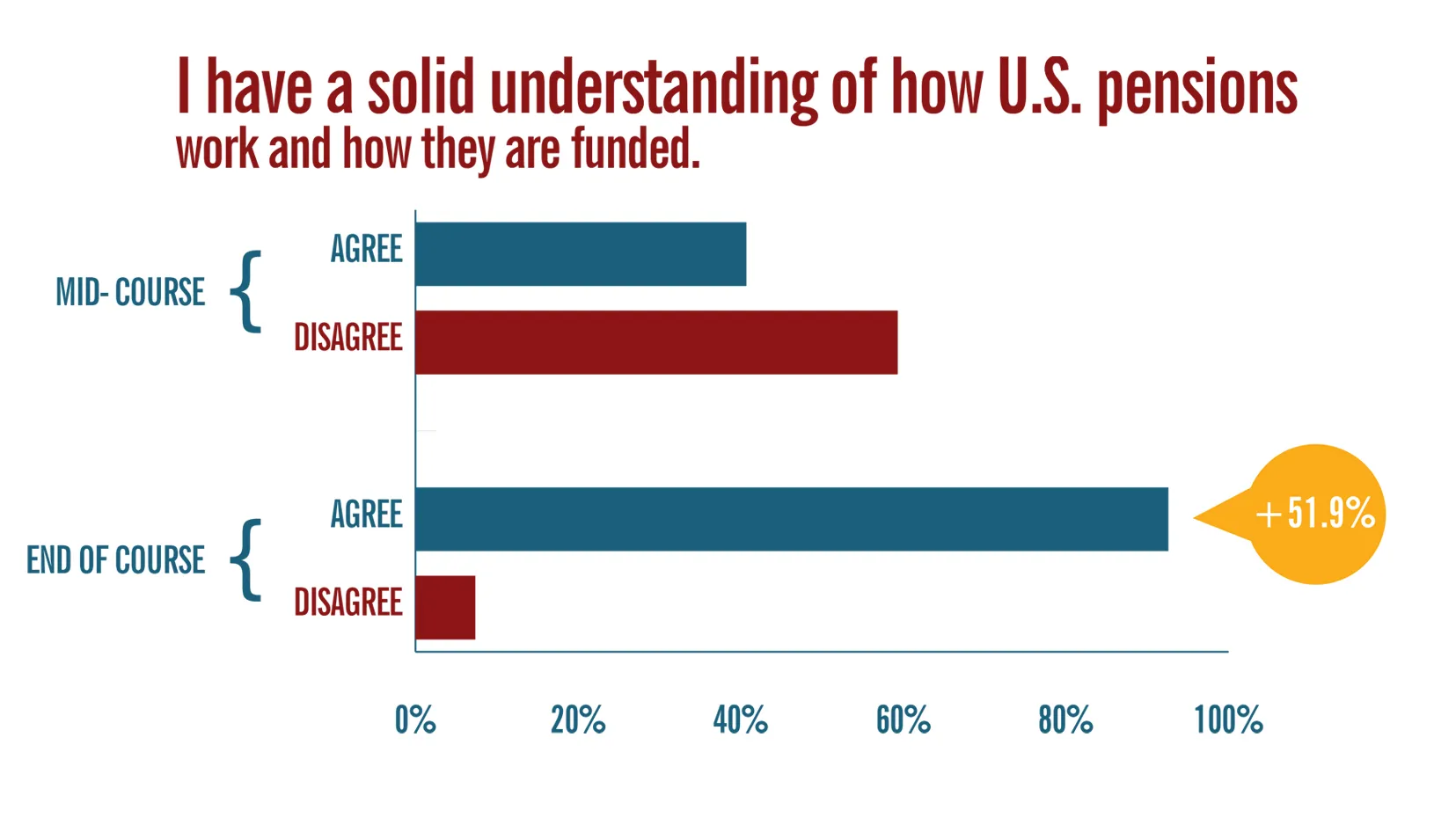

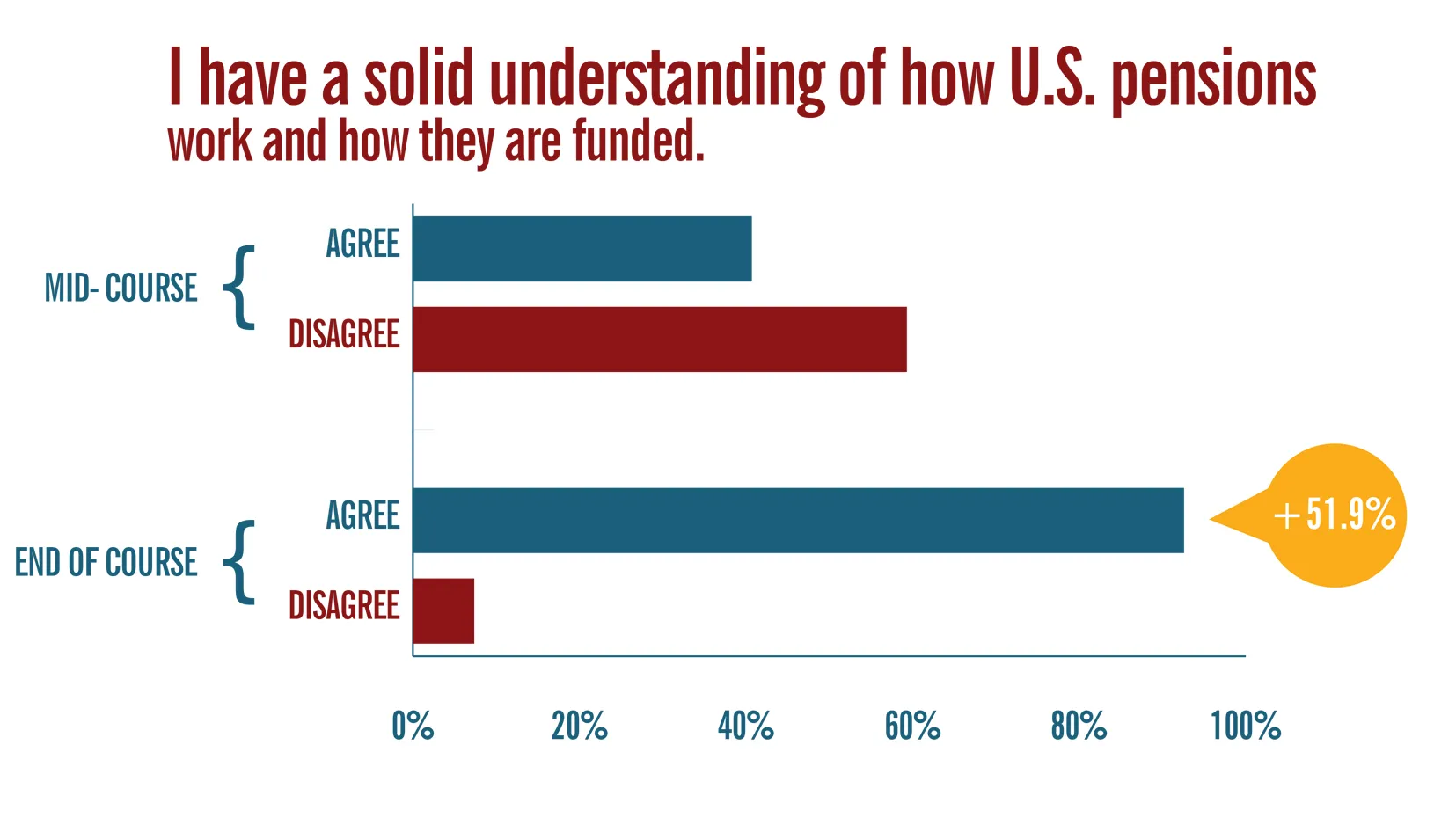

Even more dramatic was the shift in understanding relative to the state of public pensions. Early in the course, only 41% of respondents agreed that they had a solid understanding of how U.S. pension systems work and how they are funded. By the end of the course, that number had reached 93%.

The percent of participants who felt they had a solid understanding about the function and funding of U.S. pensions increased by 51.9%.

As one participant commented in an online discussion forum: “[This course] helped me think about my retirement in a new way and also made me a little aware of some aspects of public pensions — I certainly wouldn’t have considered that without this class. I particularly liked the technical analysis in the lectures combined with the pragmatic experience shared by participants in the forums.”

Based on survey data, the majority of active participants in the course were over 50 years of age, held a post-graduate degree, and either were employed full-time or retired. For those who were not already retired, 47% intended to retire in the next 10 years. Fifty-five percent of participants were from the United States.

Of all survey respondents, only 32% had a defined benefit pension plan through their employer, while 67% had a 401(k) or other type of employer defined contribution plan. In addition to these plans, respondents indicated that they are preparing for their retirement by investing in IRAs or other individual retirement savings accounts (76%). The majority of respondents invest in equity mutual funds or exchange traded funds (76%), fixed income mutual funds or exchange traded funds (55%), and individual stocks (51%), among other asset classes.

By Katie Pandes

For media inquiries, visit the Newsroom.

Explore More

Room to Grow: The Cannabis Industry Can’t Wait to Go Mainstream

Maker: United Record Pressing

Phil Knight Honored with Uncommon Citizen Award