February 07, 2018

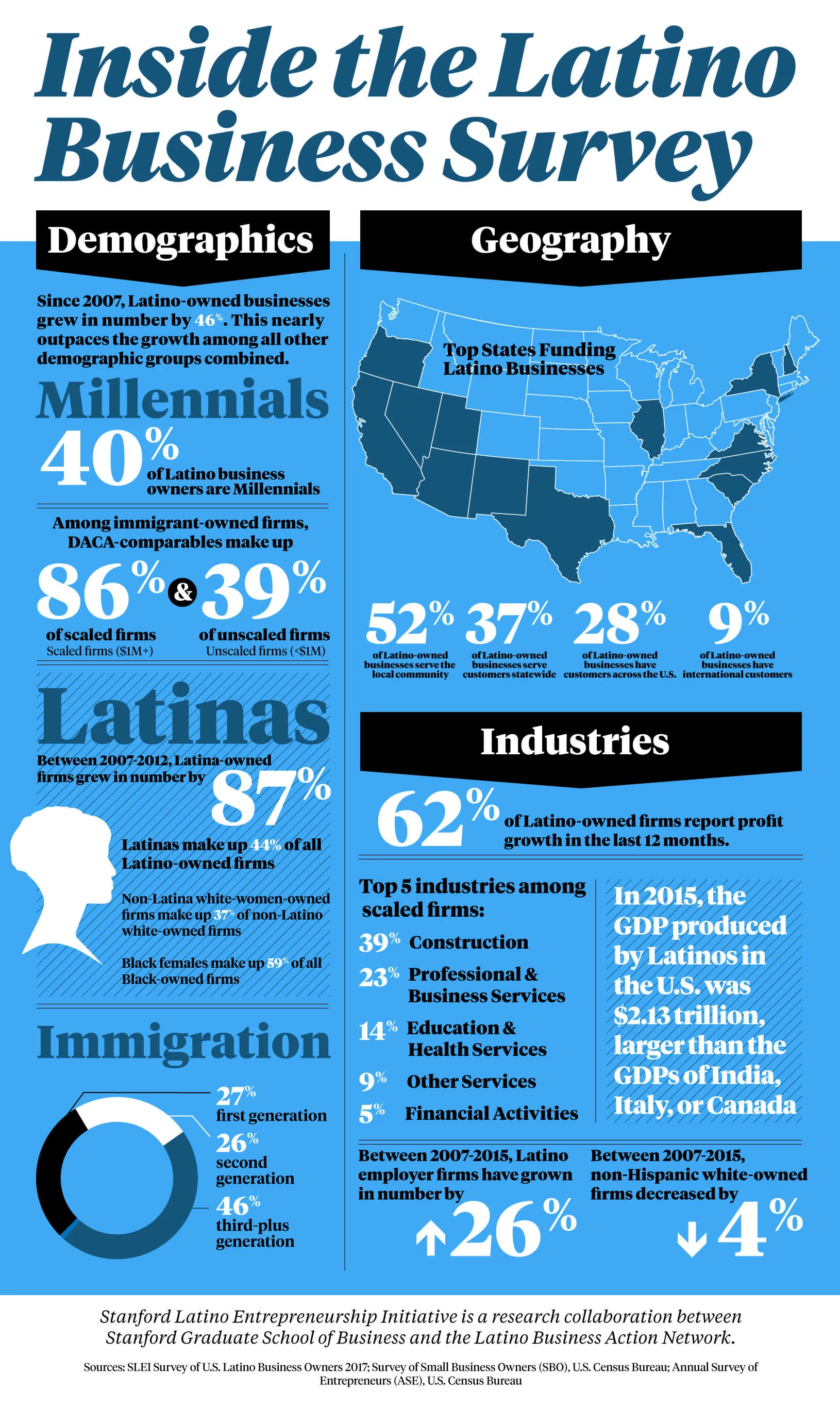

| by Kerry A. DolanDespite such challenges as inadequate access to capital, the number of Latino-owned businesses in the U.S. is growing at a rate that outpaces just about every other ethnic group, a new study from the Stanford Latino Entrepreneurship Initiative found.

The study — titled “State of Latino Entrepreneurship 2017” and coauthored by Stanford GSB professor emeritus Jerry Porras, GSB economics professor Paul Oyer, and SLEI research analyst Marlene Orozco — analyzed data from more than 5,000 Latino businesses to get insights on the entrepreneurs, their successes, and the barriers they face.

The Latino population has grown at a steady clip and now accounts for 18% of the U.S. population. However, the rate at which new Latino firms are being created outpaces Latino population growth. “Latinos have been starting businesses at an incredible rate over the past decade — a million net new businesses every five years,” says Porras, who is also the cofounder of the Latino Business Action Network. He notes, however, that most Latino-owned businesses remain small: 98% report less than $1 million in annual revenue.

The Funding Gap

One factor hampering expansion of these businesses, the study found, is limited access to capital. “It’s all about the financing,” Oyer says. “There’s a real funding gap for this group.”

In particular, national banks are a smaller source of funding to Latino businesses than to entrepreneurs from other ethnic groups. Only 12% of Latino firms employing more than one person received bank loans, compared to 18% of white-owned firms, 15% of Asian-owned firms, and 14% of Black-owned firms.

“A lot of it has to do with the size of the company,” says Orozco. “National banks are not willing to take on the risk of these smaller firms.”

In addition, many of the Latino business owners surveyed as part of the study reported that they feel unqualified to apply for a bank loan at a national bank. As a result, some may not be submitting requests for a loan.

Loans guaranteed by the U.S. government’s Small Business Administration are accessed by Latino entrepreneurs at even lower rates than borrowing from national banks, the study found. So how do Latinos fund their businesses? By tapping friends and family, finding angel investors and venture capital, and using their credit cards, Orozco says.

Millennials Rising

Another key finding in the study: A surprising 86% of immigrant-owned firms with at least $1 million in annual revenues are owned by millennials (under age 34) who came to the U.S. as children. The authors refer to this group as “DACA comparable” — those who are likely to be eligible for the Deferred Action for Childhood Arrivals immigration program, which delays deportation for undocumented immigrants who came to the U.S. as children and grants recipients the right to study or work. (Survey participants were not asked about their immigration status, so there is no way to know what percentage of respondents are actually DACA eligible.)

Why might this group of young immigrants be overrepresented among successful immigrant Latino business owners? The authors point out that they are more likely to speak English fluently and to have higher education degrees and strong social networks, all of which can play a role in building a successful business.

Also, for many young immigrants, starting their own business may make more sense than working for someone else, due to employment paperwork requirements. “Although employers may not knowingly hire an undocumented immigrant without work authorization,” the study notes, “federal and state laws do not require proof of immigration status for an individual to start a business.”

Latina entrepreneurs play an important role in creating companies, the study found. Latinas now own 44% of Latino businesses. From 2007 to 2015, nearly half of the growth in new Latino businesses came from firms started by women. That compares to much lower growth rates for female white (13%) and black (20%) entrepreneurs. While the growth is impressive, the firms started by Latinas tend to be small. Only 30% of the Latino firms with $1 million or more in annual revenue are owned by women.

Demographics bode well for continued entrepreneurship among Latinos, who make up the youngest racial or ethnic group in the U.S. One in three are under age 18 and 25% are millennials. “The bottom line,” says Oyer, “is that there’s a lot of potential activity in the Latino business community.”

Infographic by Tricia Seibold

For media inquiries, visit the Newsroom.